RootBridge diversified India Growth Fund.

- Urbanisation of India

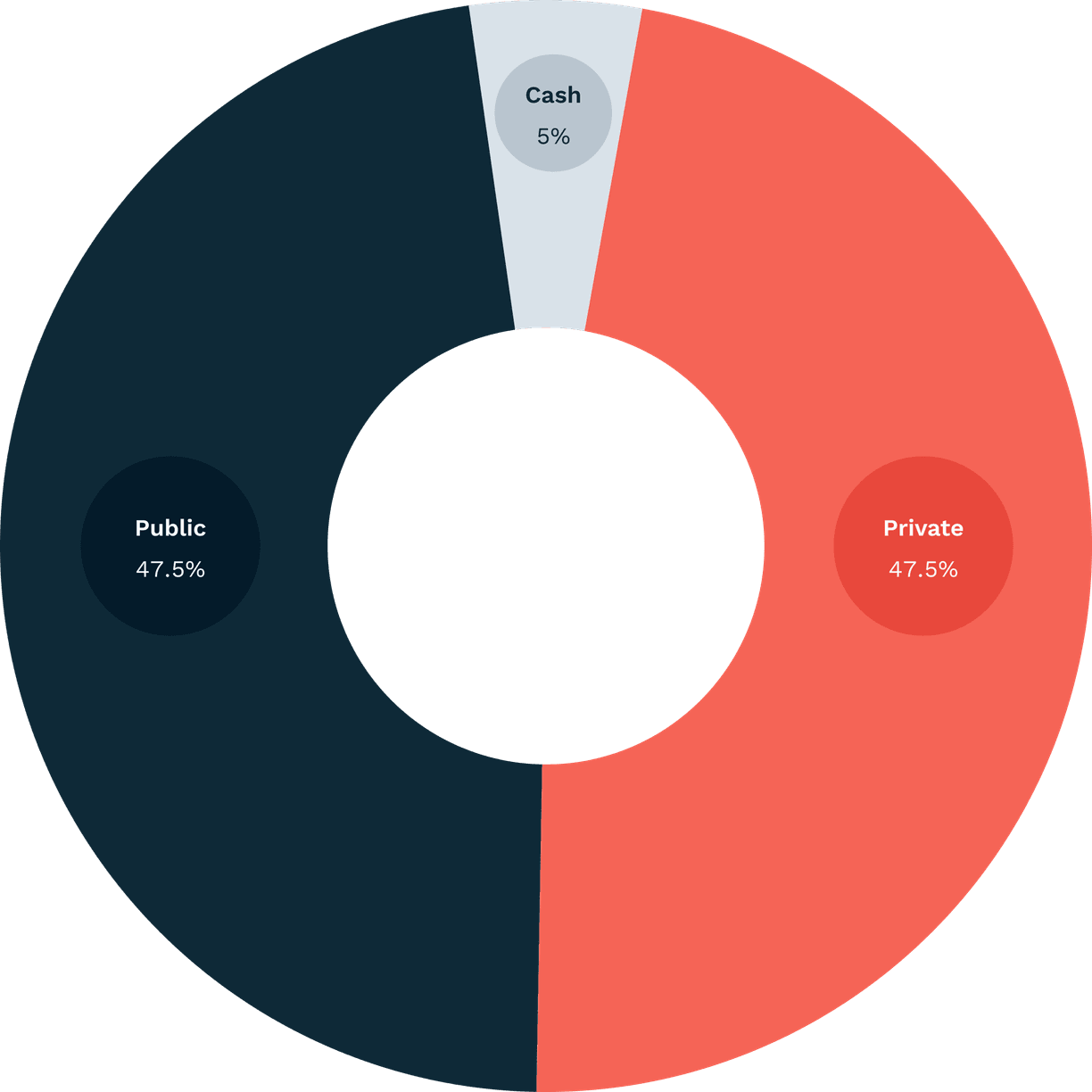

- Dual-engine strategy

- Lifecycle investing

- PIPE expertise

- Semi-liquid structure

- Evergreen model

- Dr. Ajay P. Singh, Managing Partner

RootBridge brings over five decades of on-the-ground investing experience in India, having previously deployed more than CHF 500 M in capital. The team has lived the cycles, built deep local networks, developed a track record of successful exits, and now channels that experience into a focused, high-conviction India-only strategy.

Learn more about RootBridgeNayan Srivastava

Managing Partner“After trading corporate life for entrepreneurship, accompanying portfolio companies from deal sourcing to exit has been at the heart of my work.”Louisa Clark

COO“From investor onboarding to portfolio support, legal structuring to cross-border execution, we have built the backbone and machinery to scale with precision.”Dr. Ajay P. Singh

Managing Partner“Early exposure shaped my instinct for spotting structural shifts, a mindset I have applied throughout my top management consulting career and for almost 20 years in private equity.”Vincent de Rycke

Managing Partner (Luxembourg)“With over two decades in fund management, I bring deep expertise in governance and regulation, ensuring operational readiness and long-term fund resilience.”Alpesh B. Patel, OBE

Managing Partner (UK)“In public markets, I advise institutions and governments on how to read policy, data, and narrative, helping investors cut through noise and act decisively.”At RootBridge, we are building more than a fund: we are growing a community. A place where investors, founders, and partners come together to connect, learn, and grow.

To support this, we are developing an exclusive app that will provide real-time insights, deal flow, and collaboration tools.

The app is currently in development and is expected to launch in Q2 2026.

Never miss a chance to unlock insights and opportunities in the world’s fastest-growing economy. Sign up for our newsletter today.

You're officially on the list. Fresh updates, insider news, and exclusive content are headed your way. We're glad to have you with us!